The Internal Revenue Service (IRS) has released the new limits for employee benefit plans for 2020. The IRS has increased the following benefit limits due to the inflated cost of living. We believe it’s imperative for employers and employees to be aware of the benefit regulations to ensure the compliance and maximization of benefits available. See the tables and descriptions below to understand the changes for 2020.

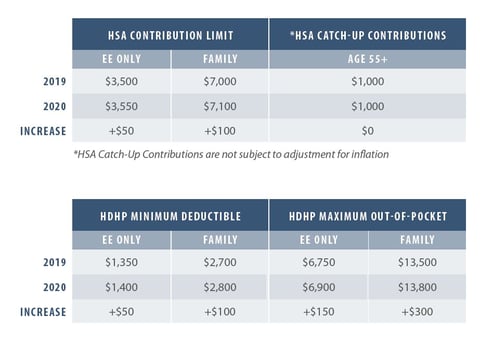

HSA Limits

A Health Savings Account (HSA) allows employees to set aside pretax income to cover health care costs that are not covered by their insurance. This benefit is only available to those on a high deductible health plan (HDHP).

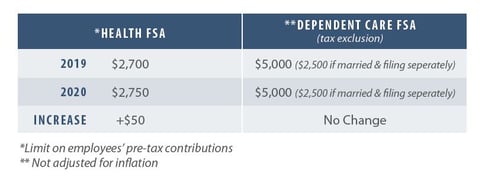

FSA Limits

A Flexible Spending Account (FSA) is similar to the HSA in the sense that pretax income is set aside for specific health costs. A HDHP is not a requirement for participation, but it is the employer’s choice to offer the FSA.

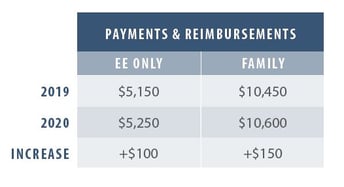

QSEHRA Limits

A Qualified Small Employer Health Reimbursement Arrangement (QSEHRA) allows companies (less than 50 employees) to reimburse employees for premiums and other qualified expenses for health insurance bought in the individual market.

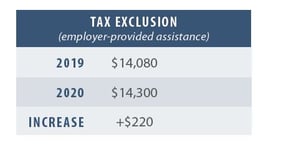

Adoption Assistance Benefits

Adoption Assistance Benefits are benefits from an employer to an employee that assists with expenses or other needs related to the adoption of a child.

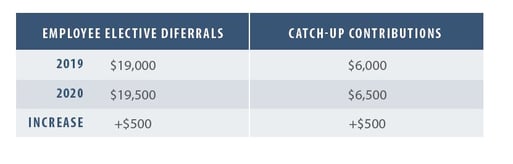

401(k) Contributions

401(k) Contributions are pre/post tax contributions to a retirement account aimed at helping employees save for retirement. Contributions can be made by both employers and employees.

Transportation Fringe Benefits

Transportation Fringe Benefits are pretax dollars used to cover commuting or parking expenses. Contributions can be made by both employers and employees.

For more information on the details and exclusions of the following plans, visit irs.gov.